This content is for information and inspiration purposes only. It should not be taken as financial or investment advice. To receive personalised, regulated financial advice please consult us here at Elmfield Financial Planning in Padiham, Burnley, Lancashire.

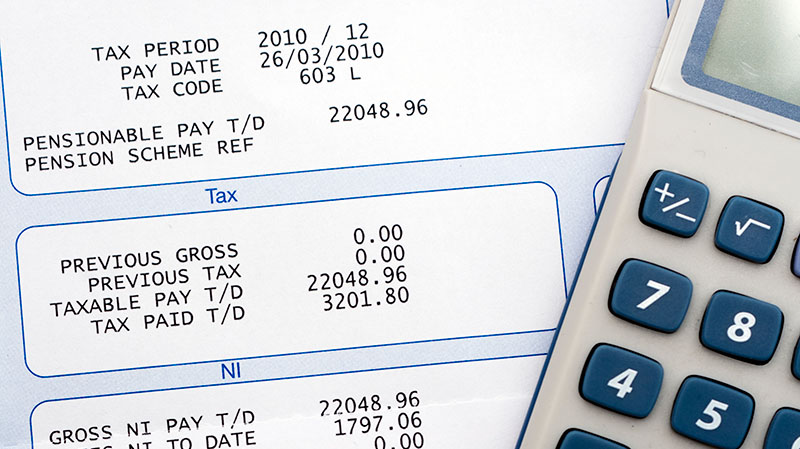

Most of us recognise “traditional” taxes such as income tax or National Insurance (NI). What is less obvious, however, is how wealth (and monthly finances) can be eroded by “stealth taxes” operating in the background, often unnoticed. Below, our Padiham-based financial planners at Elmfield Financial Planning explain how stealth taxes often work, common examples and some ideas to address them with your tax strategies.

We hope this content is useful to you and please get in touch if you’d like to discuss your own financial plan with us over a free, no-commitment consultation.

What are stealth taxes?

A stealth tax is a type of tax which is widely ignored (or not perceived) by the general populace. Without a strong understanding of the tax system, these can suddenly leave you with less money – or lower investment returns – than you perhaps expected. Stealth taxes can be useful to governments, since they provide a way to increase revenues without causing as much public outcry as, say, simply raising income tax.

Examples of UK stealth taxes

It is difficult to categorise UK taxes neatly into “stealth” and “non-stealth” taxes. This is because each person has a different understanding of the tax system. For instance, VAT (value-added tax) on certain consumer goods may not be noticed by customers looking at price labels when shopping. Today in 2022, VAT largely stands at 20%. Yet VAT stood at 8% in 1979 and was later raised to 15% (when higher and basic rates of income tax were lowered) and again to 17.5% (when council tax replaced the Poll Tax) by 1991.

VAT is a politically useful tax for a government as it can be presented as a “voluntary” tax. After all, many goods are purchased because people want to buy them. Wages, however, generally cannot avoid tax. It is always worth inquiring about which taxes apply to an important purchase before committing to it. Insurance policies, for instance, involve an Insurance Premium Tax (IPT) which most people fail to notice. Here, the standard rate is 9.5% and the higher rate (e.g. for travel insurance) is 20%.

Income tax is a particularly important area for taxpayers to be mindful of. Many people know of the Personal Allowance, which allows a worker to earn up to £12,570 without facing income tax. Yet some do know that this tax-free allowance starts to reduce by £1 for every £2 of adjusted net income over £100,000 (reducing it to zero if you earn £125,140). There is also the matter of “tax freezes” which could lead some workers to pay more taxes in the near future. Last Spring (2021), then-Chancellor Rishi Sunak announced a four-year freeze of income tax bands (until April 2026). This was widely considered a stealth tax since the average UK wage growth expected in this time could push £1.2m more workers into paying the Higher Rate of income tax (40%). This could have further knock-on effects on these workers’ taxes. For instance, a Basic Rate taxpayer can earn up to £1,000 interest without tax (outside an ISA) but someone on the Higher Rate sees this threshold lowered to £500. Therefore, some people could start paying tax on interest without realising it – and then, at the 40% rate rather than 20%.

Ideas for navigating UK stealth taxes

The best way to avoid needless stealth taxes is to work with a financial planner who can help you keep up to date about the tax system and how it affects you. However, educating yourself about these matters will also equip you for wise decisions. Some ideas to consider include:

- Using your pension. When you make a pension contribution (e.g. to your workplace scheme), it receives tax relief equivalent to your highest marginal rate of income tax. This means that a pension is not only useful for preparing your retirement fund, but also for potentially saving on tax. For instance, suppose your salary is set to rise to £55,000 next tax year, up from £50,200. This would take you into the Higher Rate, leading £4,730 to be taxed at 40%. However, if you diverted this extra pay into your pension, the money would not be taxed. In fact, the government would give your contribution a 40% “boost”!

- Using your ISA. If you are worried about tax on your interest from saving (particularly as interest rates rise), then moving some of your cash into an ISA might be a good idea. Yet be aware that you are limited to putting £20,000 into ISAs each tax year, and most of the allowance will likely still be better-used towards investments offering a higher potential return (e.g. shares). Make sure that any potential tax savings are not outweighed by any potential opportunity cost from not investing your money instead.

- Beware of pension allowances. Pensions are powerful tools for saving for retirement. Yet they come with complex rules that are easy to fall afoul of. Be careful, for instance, of the Money Purchase Annual Allowance (MPAA) which lowers your annual allowance from a maximum of £40,000 per year to £4,000, if triggered. Also, be mindful of the total tax-free limit that you can save across your pensions. This is called the Lifetime Allowance and is set at £1,073,100 until 2026.

Invitation

If you are interested in starting a conversation about your own financial plan or investments, then we’d love to hear from you. Please contact us to arrange a free, no-commitment consultation with a member of our team here at Elmfield Financial Planning in Padiham, Burnley, Lancashire.

Reach us via:

T: 01282 772938

E: info@elmfieldfp.co.uk