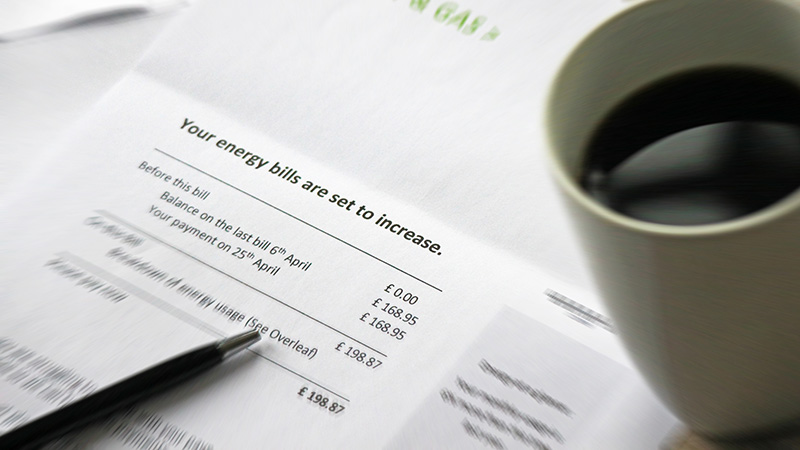

The rising cost of living is giving many households much pause for thought in 2022. More than 50% of UK homes have reduced their gas and electricity consumption as energy costs spiral, and 1.66m video streaming subscriptions have been cancelled (mostly by young people) in the second quarter…

Recent Comments